Commodity Giving

A donation or pledge of crops or livestock can be a great way to support the Kansas FFA.

Gifts of Commodities

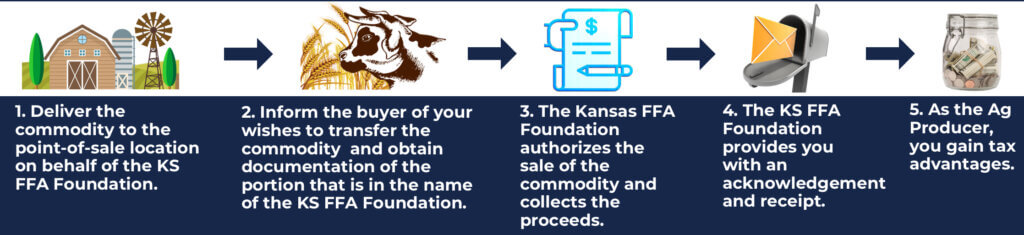

- Prior to delivery of the commodity, complete the Commodity Giving Form. Send the completed commodity form to [email protected] or mail to 110 Umberger Hall, KSU, Manhattan, KS 66506.

- Best practice is to give the elevator or sale barn advance notice of your plan. Then, upon delivery of the grain or livestock, inform or remind them you are delivering the property on behalf of the KS FFA Foundation.

- Get written documentation (such as a storage receipt) of the portion of your delivery of grain or livestock that is in the KS FFA’s name.

- After the transfer of the commodity, the Foundation assumes the risk, including storage, transportation, marketing and price risk.

- Instruct the elevator or sale barn not to sell the grain or livestock until it is contacted by the Kansas FFA Foundation. Because the Foundation owns the grain or livestock following your transfer of property, the donor must give up control before the sale.

- Notify the KS FFA Foundation the property has been delivered to the elevator or sale barn. We will then contact the elevator or sale barn to direct the sale and send you an acknowledgment letter for the donation.

- When possible, please remind the elevator or sale barn the check for proceeds from the donated commodity needs to be addressed and sent to the KS FFA Foundation. In most cases, the KS FFA Foundation will have an account established with the sale barn or grain elevator.

- We encourage you to talk to your tax advisor for additional information regarding commodity gifts.

FAQ about the Gift of Grain Program

What is the advantage of contributing my grain compared to a cash contribution?

Often, a producer will decide it makes more sense to send a truck load of wheat or other grain to the elevator rather than write a check. Using this program, whether your grain is coming out of the field or the bin, you can create a tax-deductible contribution to the Kansas FFA Foundation. A gift of grain can reduce adjusted gross and taxable income, income and self-employment tax. The Foundation Staff is here to answer your question about our Gift of Grain program and can be reached at 785-410-7313 or [email protected]. If you would like to talk about advantages other than the tax deductible nature of your gift, we encourage you to talk with your financial or legal counsel about the benefits.

What steps are needed to make a Gift of Grain to the Kansas FFA Foundation?

Please contact the Kansas FFA Foundation about the intended gift of grain. We will gather some needed information to help move the process along smoothly. Once the arrangements are set, deliver the grain to your elevator of choice and transfer the grain quantity into the Kansas FFA Foundation’s account at the elevator. Notify the Foundation that the grain has been delivered and, that’s it. The Foundation will contact the elevator to direct the sale of the property.

What grains are acceptable?

Virtually any marketable crop can be used to take advantage of the Gift of Grain program.

How long is this program going to be available?

The Gift of Grain program will remain in effect for many years to come. As matter of fact, a pledge of grain for multiple years is greatly appreciated.

Can I use a donation to the Gift of Grain program to satisfy the pledge payments of my Kansas FFA Foundation donation?

Yes. We have many donors who have made donations using the pledged method and, your Gift of Grain can be used as a payment for a pledged donation.

More Questions?

Email [email protected] or call 785-410-7313